Commercial Solar Incentives Are Still Strong

Federal 30% Reduction in Project Costs for Business, Non-Profit, and Municipal Installations

Commercial Solar in 2026: A Smart Financial Move for Your Business

Commercial solar isn’t just an environmental choice—it’s a strategic investment. With federal incentives still available in 2026, businesses that act now can significantly reduce operating costs, increase property value, and achieve strong returns on investment.

Work with a locally owned and trusted partner to take advantage of major savings and incentives available to businesses in 2026.

Pressure-free and education-based, we are here to help you sort through the options and make the best decision for your business.

Reduce exposure to rising electricity rates as more data centers come online

Guarantee predictable, long-term operating costs

Invest for a strong financial return on a capital improvement

Incentives:

30% of total eligible project costs becomes a tax credit (business) or direct rebate payment (non-profit, municipality)

Accelerated depreciation option (MACRS)

State tax credits where available

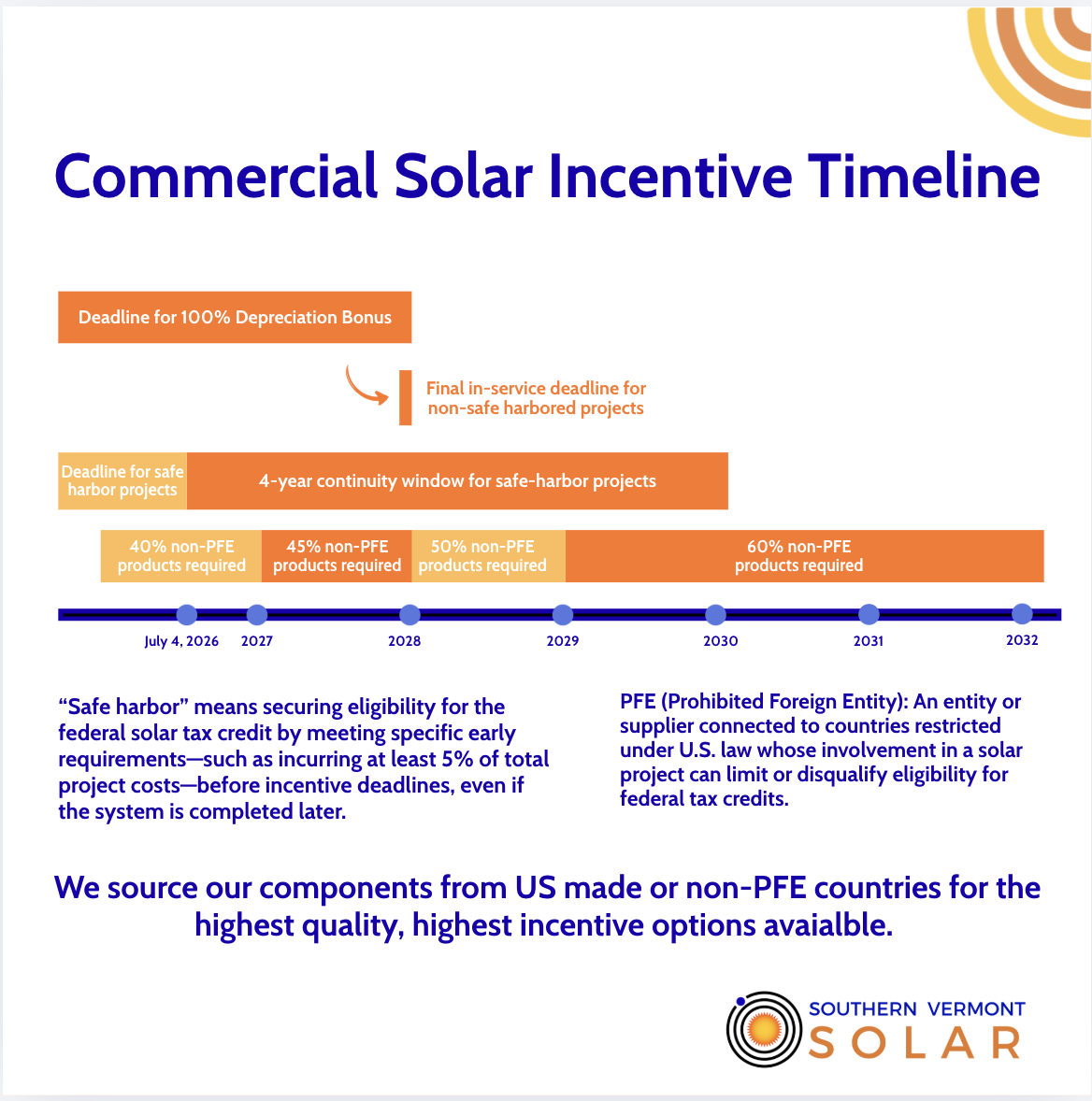

Deadline Breakdown

Safe Harbor, July 4th, 2026

If 5% of your project expenses have been spent by this date, you have four years to complete your project, allowing you to secure the incentive while delaying costs to the end of 2029. This is the Safe Harbor.

Projects On-Line by December 31st, 2027

Regardless of when your project began, if it is fully online by 12/31/27, the full 30% incentive will be available. A Safe Harbor is not needed as long as the project is completed and connected to the grid by the deadline.

Projects in service by 12/31/27 date also qualify for 100% bonus depreciation, which allows businesses to deduct the full cost of a qualifying solar or battery system in the first year it is placed in service, significantly reducing taxable income and improving cash flow.

What This Means For Your Business

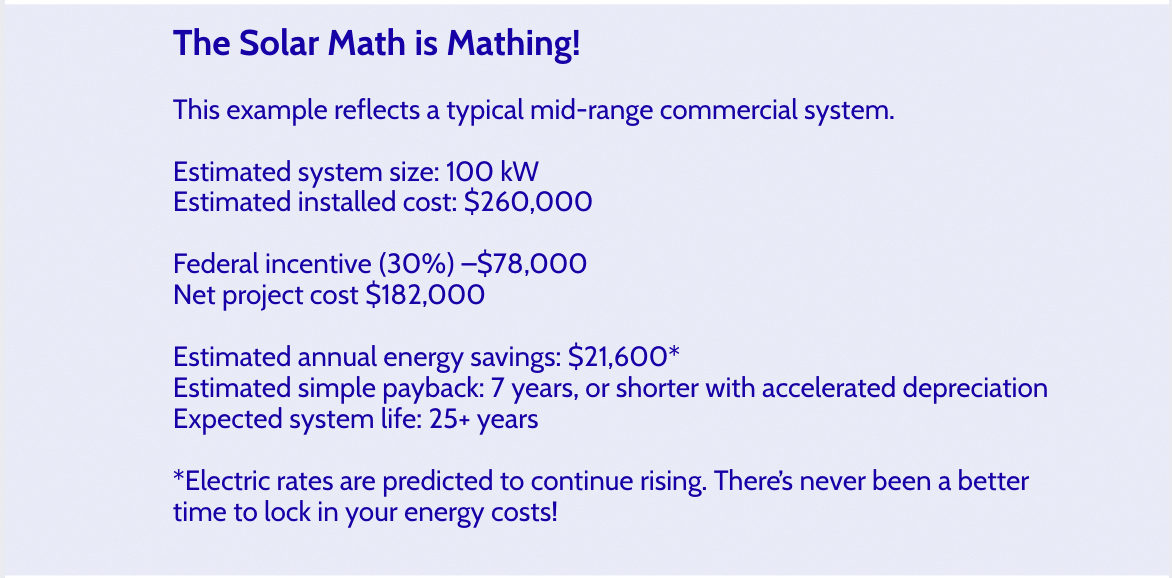

With energy savings, tax credits, and depreciation benefits combined, many commercial solar projects see:

Typical payback periods of less than 10 years

25+ years of predictable energy savings

Timing and Next Steps

To preserve eligibility for federal incentives, planning begins now. We help business owners and decision-makers navigate this process by providing:

Detailed site and structural review

Financial cost-benefit analysis and break even schedule

Optional guidance from our tax advisor – we support your business every step of the way to ensure the full incentive is captured within the deadlines.

Schedule a conversation with us today:

Confirm whether solar is a fit for your location

Refine cost and savings assumptions

Map a timeline that protects incentive eligibility